Renters Insurance in and around Oxford

Your renters insurance search is over, Oxford

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Think about all the stuff you own, from your TV to stereo to camping gear to coffee maker. It adds up! These personal items could need protection too. For renters insurance with State Farm, you've come to the right place.

Your renters insurance search is over, Oxford

Renting a home? Insure what you own.

Why Renters In Oxford Choose State Farm

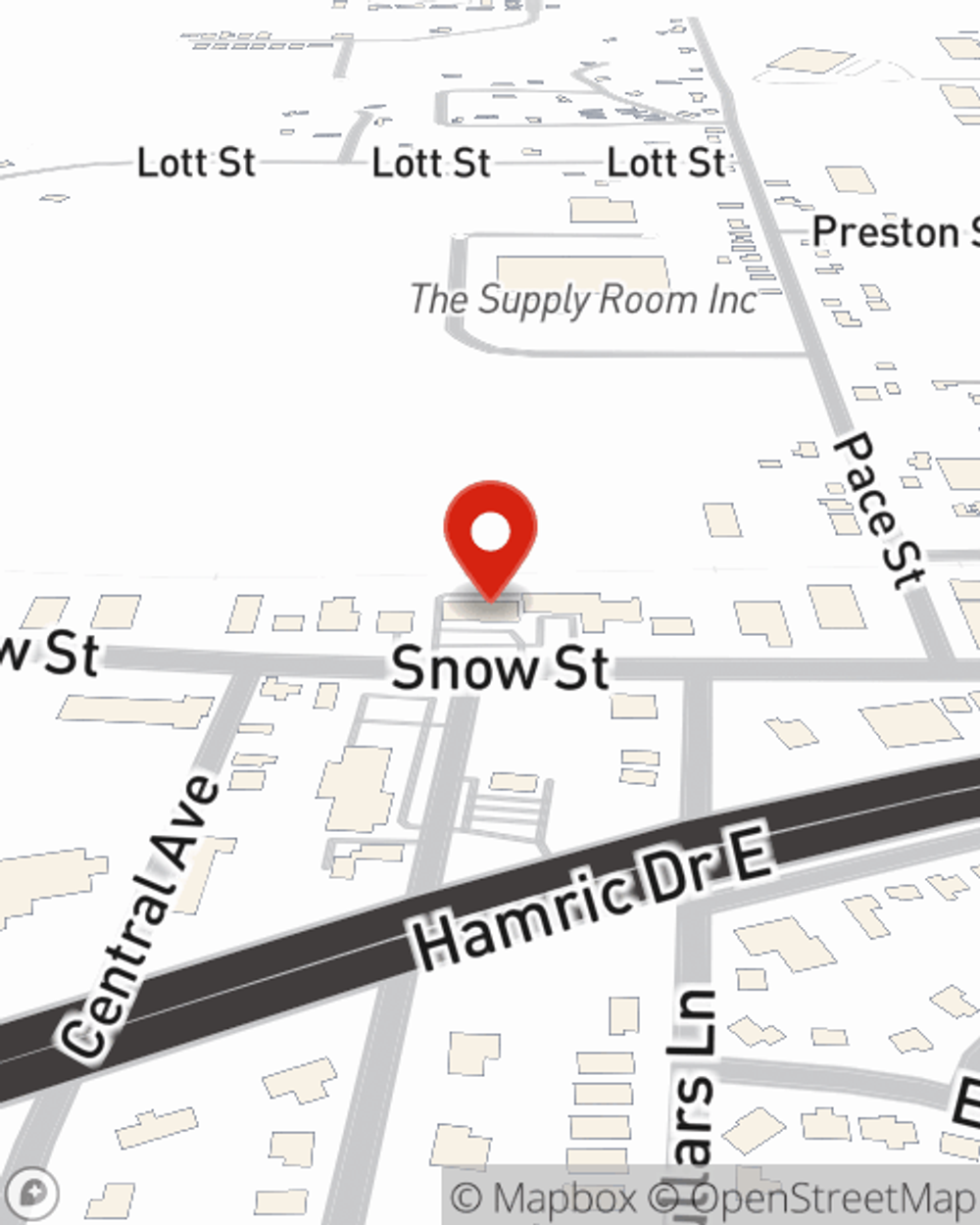

When renting makes the most sense for you, State Farm can help guard what you do own. State Farm agent Anthony Fleming can help you identify the right coverage for when the unexpected, like a fire or an accident, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Oxford renters, are you ready to see how helpful renters insurance can be? Contact State Farm Agent Anthony Fleming today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Anthony at (256) 237-9408 or visit our FAQ page.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Anthony Fleming

State Farm® Insurance AgentSimple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.